2. Annuities Have High Fees

The truth is there are many annuities that have absolutely no fees at all. As a matter of fact, a fixed index annuity is a no fee product. However, if you would like an enhancement or an accelerator to say bump up the participation rate or the death benefit you can certainly opt for that if it makes sense to you. The truth be told mutual funds, stocks and bonds offered from brokers do have high fees. Anywhere from 1.3- 4% which could shorten your monies longevity 10 years shorter in retirement. These fees could be higher than the surrender fees in an annuity over time. What has always fascinated me is that your broker or financial advisor representing these products make the same fee every year even if you are losing money. I am going to pay and advisor a fee (your hard-earned money) to lose money?

4. I Don’t Get All the Market Gains

True, but you also don’t participate in any losses. You never lose your principal. If the market goes down 30-40% as in 2008 you stay and hold. Zero becomes your hero. You only go up or sideways and never give back any gains. If you lose 30% you will need almost a 43% gain just to get back where you started or even. Compounding that lose, if you are in retirement, you may already be taking distributions to live on which in that case you may never get back to even.

5. There are Other Options That Can Do Better

If you do any research on the internet you hear a lot of bad press about annuities from folks who simply do not understand the many variations of annuities in the marketplace today. The key is to ensure you have the proper design for your personal goals and a good advisor who ask the right questions for example, one of the main benefits of many index annuities is the ability to guarantee no lose of principal on the original investment. Other than cash, very few programs exist that can do this. With index annuities, you can not lose your principal, which is protected by the full faith and credit of the A rated issuing companies. This is not what happens with bonds, stocks, mutual funds, and ETFs in a rising interest environment.

You might say how can they do that; the issuer of the annuity program will purchase options on the underlying investments, which tend to feature various indexes as well as cash. Since thy do this with other investors they can buy in huge economies of scale whereby they can turn those options int considerable profits.

6. Annuities Are Expensive with High Fees

Indexed Annuities are a no fee product unless you want to enhance say the spread or participation rate (PAR) offered. For example, to enhance the PAR from 150% to 200%, or a fee for long term care (LTC). That is up to the prospect but not added automatically. The annuities that are or can be expensive are the variable annuities as you are right back in the Wall Street Casino with fee and in many cases a lot of hidden fees.

Many of the latter do have penalties for early withdrawal, which are called surrender charges. These tend to reduce over time and eventually disappear in most programs available for today’s investors.

For example, say an individual put $300,000 into a contract with a surrender charge of 8%. If they did not have other liquid funds and soon after ended up needing money, most contracts allow the first 10% to be disturbed at no charge. So, they could pull out $30,000 without a penalty. But if they needed $50,000 for an emergency, approximately $20,000 after the free withdrawal amount would incur the 8% surrender penalty to the tune of approximately $1,600. Not the end of the world for an emergency, but good to be prepared for at the outset.

When compared with similar strategies over specified time periods, in many cases, the annuities being evaluated are cheaper than alternative investments that charge upfront or ongoing fees. For example, the costs of a classic separately managed account — which might have combined fees of 1.35% every year — over time could add up to more than what an investor would pay for an annuity, even after accounting for assumed surrender charges down the road. This alone can take 7-10 years off the longevity of your money. This cost comparison is a simple calculation that is misunderstood by both the public and many who write about the cons of annuities.

7. The Returns Are Not Good

Like every financial strategy offered, this depends entirely upon what they are being compared to. If you compare some index annuity strategies to a pure S&P 500 type index (or similar investment) in an up market, it is likely they will not compare favorably. But to get the rewards the S&P offers, you must be willing to accept a high degree of risk and in retirement can you really take that risk, something you could avoid with an annuity.

When annuities’ returns are compared to cash on the other hand, they will often seem significantly better suited to produce some upside, including even those with caps on returns, for the same virtual safety associated with a no-loss-of-principal asset class. Unlike cash, of course, they are meant to be held longer term and if not, may incur some surrender charges.

However, since annuities have gotten so popular the issuing companies are now getting much more aggressive with added features and benefits. Such as unlimited upside of the index some now paying 200% of an index or including long term care or enhanced death benefit for legacy planning.

Like everything else in financial services, the true costs of this are easily comparable and rarely if ever acknowledged by those who categorically denounce annuities. The favorable cost comparison is especially true for many of today’s index annuities, which is one of the reasons why 2019 was a record year in fixed annuities.

8. Annuities Are Complicated

Like anything designed to protect downside, most index annuity programs use algorithms to manage the weightings of their underlying indexes daily. Annuities may seem too complex for the average individual to understand, however illustrations that include the impact of guarantees can be back tested based on historical performance. I call it the Good, The Bad, and the Ugly.

The illustration will look at the worst 10 years out of 20. The best and the most recent to show how the index performed. These illustrations tend to demystify the impact index annuities can have on an investment portfolio and accentuate the benefits of safety in volatile markets.

As with all investment options, there are trade-offs. However, if protecting principal while providing upside is something an investor needs or wants, an index annuity may be the best option out there. Consult a financial adviser who is licensed to represent and sell index annuities before crossing them off your list and pay attention to the facts. Myths will never help you achieve your financial goals, but solid advice certainly can.

If you do any research on the internet you hear a lot of bad press about annuities from folks who simply do not understand the many variations of annuities in the marketplace today. The key is to ensure you have the proper design for your personal goals and a good advisor who ask the right questions.

With the proper design and an ethical advisor that will ask the tough questions to assist you in meeting your desired retirement goals a Fixed Index Annuity just might be something to add to your retirement portfolio.

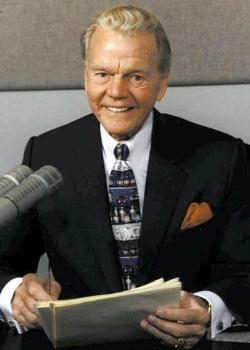

Len Strickler is the Co-Founder and CEO of LS Financial Group. His passion and mission are to assist as many retirees as possible in getting out of the Wall Street Casino off the high risk market Roller Coaster and into SAFETY, never losing principal and receiving nice up side gains and Guaranteed Life-Time Income.